Re visiting our 2 Calls from late last week / weekend ! GBP USD played ball and in true FX fashion pierced our support and held below for a number of hours before creeping back above in a 2 day bounce not even worthy of a lifeless cat ... This morning sees it under a little early pressure im expecting a fairly quick break down now (3/4 days) back through those lows and to begin carving out a new trading range in the mid to high 1.20's ... lets see ...

Perhaps more interesting is Equity land where our favoured short , the nasdaq 100 has broken lower and is as i write re testing the cluster of averages and technical levels in the 4390/4410 area (A on the chart) . This is the perfect re - sell area for a new and much more concerted fall ... Im still amazed at the total complacency of Longs even the brazen longs on twitter mocking the 2 day sell off as a blip and congratulating themselves on buying the dip again !! Caveat Emptor !

Wednesday 29 June 2016

Sunday 26 June 2016

REAL TROUBLE AHEAD FOR THE POUND

GBP/USD FX (Monthly chart above) ... Fridays low wasn't an accident .. 1.3228 is the key the next 30 points in this cross .

The total surprise nature of the Brexit vote again is critical here ... at 11pm on referendum day we printed a yearly high in GBPUSD ..The remain vote was albeit nailed on and you would have had a very hard job for making a case to be Short the pound .. hence the move obviously. This is a notoriously volatile cross with a love of over extension .. 2 was always seen as physcological level that was unsustainable so it spent the best part of 2007 pushing 2.10 before collapsing at the first hint of the 2008 crisis ... We have a much lower level to fall from today and with sparce liquidity, a market that is positioned very badly and a hamstrung central bank i fear we may see a serious over extension again but this time to the downside ... Clearly Fridays low 1.3228 is the key .. if we see a significant break and hold through that level the unthinkable becomes thinkable ... Parity against the Dollar !! GAN.

Saturday 25 June 2016

Complacency .... Complacency ... Complacency

Not sure what the fuss is about .... Back to where we were last Thursday .... Still up on the year .... The same sentiment echoed across dealing rooms and social media around the world on Friday in response to the Historic Brexit decision from the UK. After the dust had settled we'd had a pretty decent sell off in risk assets and of course the pound but its the complacency that worries me , a lot!

The whole bull run in stocks back up from 2008 lows has been maligned. We have rallied pretty much in a straight line for most of that time pausing for breath along the way but most people seemed to deem it a house of cards and have been keen to declare its vulnerability jumping on every selloff as a new crash and calling the end of the world ... until that is .. now !!

Sentiment has changed and its changed quickly ... now my social media timeline is full of dip buying recommendations , the news isn't that bad .. it always bounces right ??

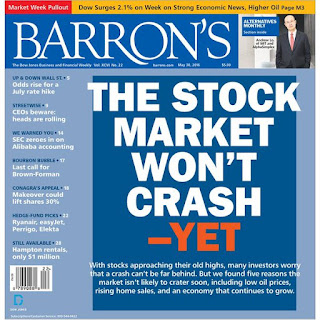

Barrons 28th May cover was a major warning signal .... A huge red rag to a Bear if you pardon the pun !!

Friday was a horrible day across the board pretty much but the standout was the Nasdaq 100. Rammed with spec long money its the index where the major bio tech and real tech darlings live ... its jammed with late to the party hot money longs.

I think the real clue about Friday was the close .. it closed nicely below the 2 previous lows .. as you can see from the chart we have an initial target in the low 3800's but i fear that maybe just the beginning ...this noticeable sentiment shift takes out the short covering that used to accompany major sell offs .. instead we ll have vacuum gaps lower and we could easily see 3400 in this index.

World stocks are in serious trouble over the next few months and maybe a much longer time frame we will have to see if sentiment changes but in my experience this is only the beginning ! GAN.

Subscribe to:

Posts (Atom)